Invest With Purpose, Grow With Integrity

Clarifying Personal Principles

Translating Beliefs Into Screens

Choosing the Right Approach

Blueprint for a Principled Portfolio

Value‑Aligned Asset Allocation

Diversification Without Compromise

Balancing Return, Risk, and Purpose

Finding Truth Behind the Labels

Interpreting ESG Scores Critically

ESG ratings often diverge because agencies weigh issues differently and use distinct data. Instead of chasing the highest score, examine what drives it: policies, performance, or publicity. Prioritize materiality by sector, scrutinize controversy histories, and track trajectories. Seek consistency across disclosures, independent audits, and board oversight to separate genuine leadership from well‑packaged promises.

Engaging With Fund Managers

Ask specific questions: Which standards guide research? How are screens implemented and monitored? What controversies triggered divestment or engagement? How do managers vote proxies, escalate dialogues, and report outcomes? Demand holdings transparency, stewardship case studies, and fee clarity. Favor teams that demonstrate repeatable processes, thoughtful trade‑off management, and humility when evidence challenges assumptions.

From Investor to Advocate

Proxy Voting With Intent

Constructive Dialogue With Companies

Collaborative Initiatives and Policy

Accounts and Wrappers

Product Toolkit

Automation and Rebalancing

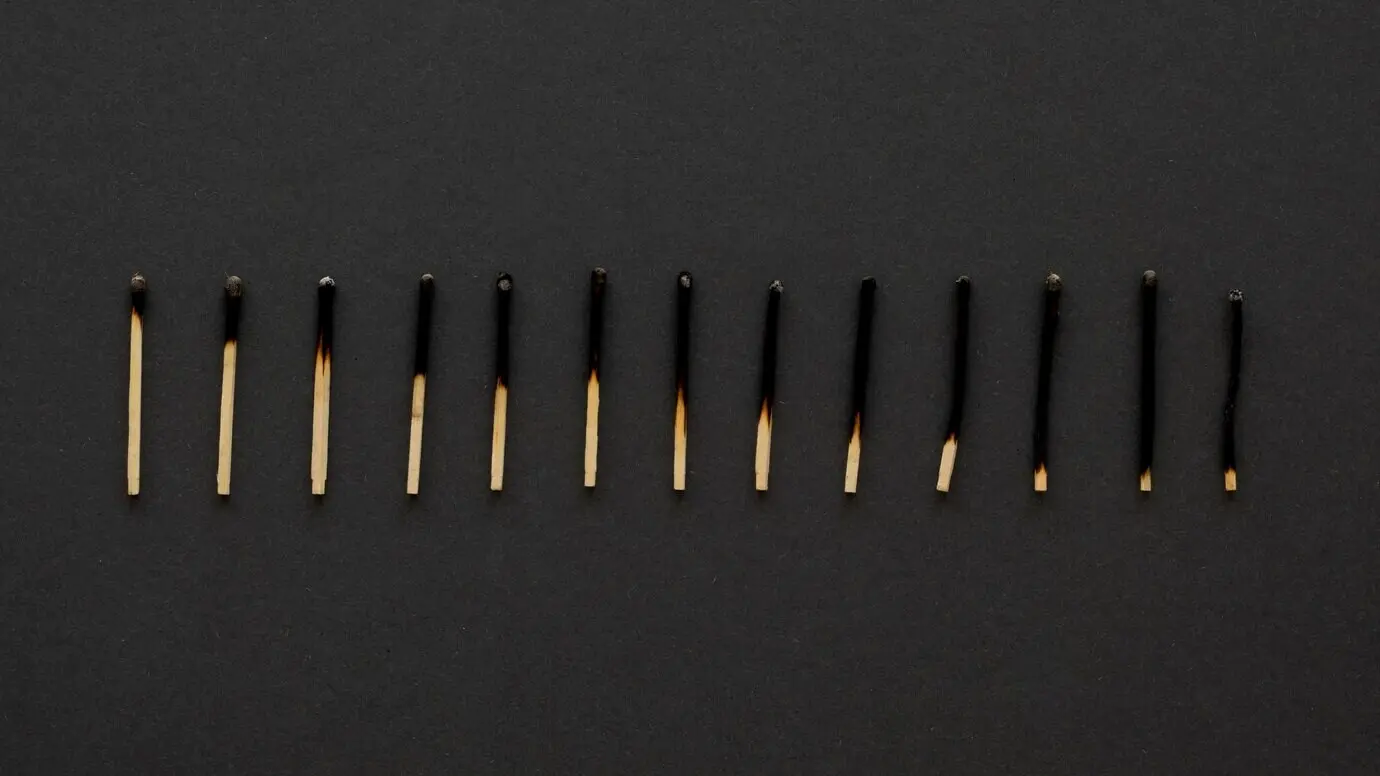

Seeing What Matters

Journeys of Money With Meaning

Define and Prioritize

Build a Starter Portfolio

All Rights Reserved.